Or, fill out and send one of the following forms: membership in professional, social or recreational organizations.

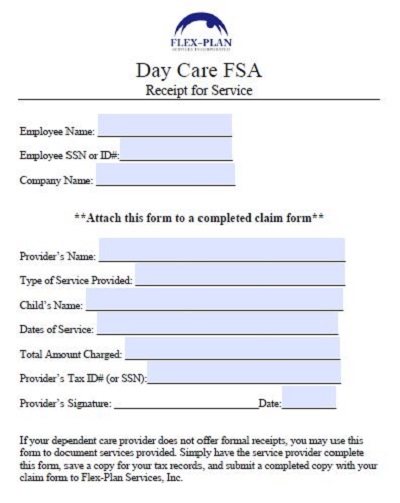

CHILD CARE EXPENSES RECEIPT TEMPLATE REGISTRATION

driver’s license and vehicle registration (front and back).certificate of residency issued by the CRA.

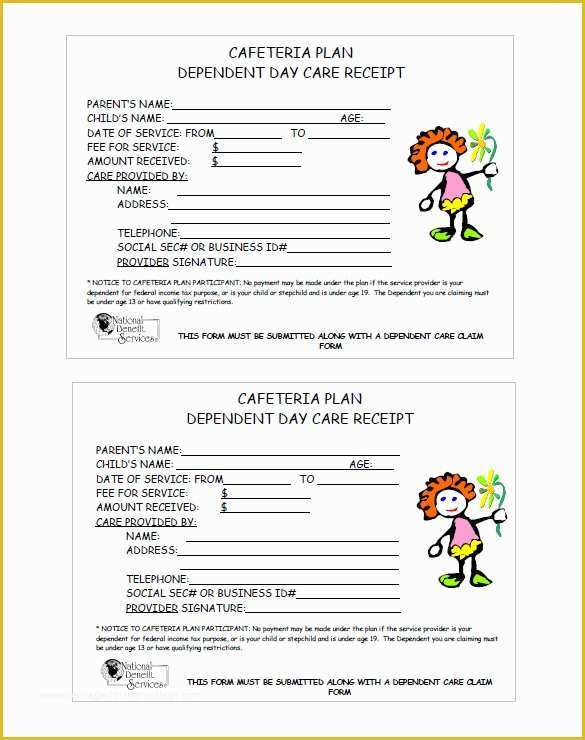

CHILD CARE EXPENSES RECEIPT TEMPLATE FULL

To confirm that you are considered a resident of Canada for tax purposes, send us photocopies of any of the following documents that contain your full name, address and the date for each year being reviewed :

registered retirement savings or employment pension plans.recent utility bill(s) (gas, electricity, cable, telephone).lease agreement, rent receipts or letter from the landlord.mortgage papers or your property tax bill(s).To confirm your marital status, send us any of the following documents that show there has been a change to your situation for the period under review.ĭocument 1 – a rental agreement showing both your name and your spouse or common-law partner's nameĭocument 2 – a rental agreement dated after your separation, in your name only. If you cannot get documents or information due to your current situation, we can help! Visit the Getting benefits and credits when in an abusive or violent situation page to find out about Sending information or documents to the CRA. You will never need to contact an abusive spouse or common-law partner to provide information to the CRA. Supporting documents must apply to the entire period under review. If you don’t reply, your child and family benefits may stop.

It's important that you reply and provide all the information requested by the CRA. This is to make sure that you get the right amount of benefits and credits. The Canada Revenue Agency (CRA) may request documents to confirm:

0 kommentar(er)

0 kommentar(er)